Oil fees rose with the aid of using greater than 2% on Friday on expectancies of a drop in Russian crude supply, which helped offset concerns of a success to U.S. shipping gasoline call for increase as a looming Arctic hurricane threatens tour throughout the vacation season.

Brent crude changed into up with the aid of using $1.72, or 2.10%, to $82.70 a barrel at 1305 GMT, whilst U.S. West Texas Intermediate (WTI) crude changed into at $79.37 a barrel, up $1.88, or 2.37 %.Both contracts have been up with the aid of using greater than $2 in step with barrel in advance on Friday and on the right track to publish their 2nd weekly gain.

Russia`s Baltic oil exports should fall with the aid of using 20% in December from the preceding month after the European Union and G7 countries imposed sanctions and a rate cap on Russian crude from Dec. 5, in line with buyers and Reuters calculations.

Russia may also reduce oil output with the aid of using 5%-7% in early 2023 because it responds to rate caps, the RIA information corporation noted Deputy Prime Minister Alexander Novak as announcing on Friday.

Crude fees are better as strength buyers attention on Moscow’s reaction to the rate cap placed on Russian oil and now no longer a lot the lots of flight cancellations so that it will disrupt excursion tour,” OANDA analyst Edward Moya said.

More than 4,four hundred U.S. flights had been cancelled over a two-day length because of the wintry weather hurricane, coinciding with a vacation tour season that a few are expecting might be the busiest ever.

On Thursday, oil fees on each facets of the Atlantic settled decrease as flights have been scrapped. The snow hurricane can also upend motorists’ plans to tour throughout Christmas and New Year, curtailing fuel intake.However, heating oil call for might be boosted as the acute climate is anticipated to reason electricity outages.

As U.S. crude oil inventories fall and wintry weather storms hit the U.S., bloodless temperatures are anticipated to increase southward to Texas, Florida, and the jap states. Demand for heating oil will soar,” Leon Li, an analyst at CMC Markets, said.

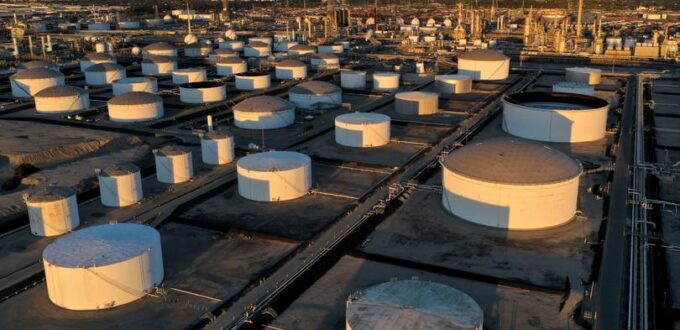

U.S. crude shares fell greater than anticipated withinside the week to Dec. sixteen as imports dropped sharply. [EIA/S]However, surging COVID-19 instances withinside the world’s No.2 oil client China, issues approximately in addition fee hikes globally and recession curtailing gasoline intake restricted oil’s rate gains.

The oil market’s largest wildcard is China and optimism continues to be robust that the reopening will keep and in the end result in greater call for,” OANDA’s Moya said.Reporting with the aid of using Dmitry Zhdannikov in London, Florence Tan and Emily Chow in Singapore; Editing with the aid of using Mark Potter, Kirsten Donovan .

No Comments Yet